Holguín bank provides credit support for new actors in the economy

- Written by ACN

- Published in Holguin

- Hits: 1030

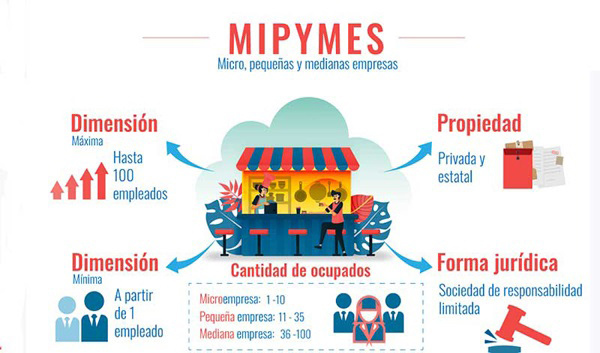

About 70 Mipymes (Micro, small and medium-sized enterprises) officially constituted in Holguín are currently benefiting from the portfolio of credit opportunities offered by the Bank of Credit and Commerce (Bandec) in this province, which favors the development of these new actors of the Cuban economy.

Yoania Calderón Martínez, Head of the Department of Corporate Banking in the Provincial Directorate of Bandec, told ACN that these benefits are a priority for the local banking system, since with these actions the national economy also grows in the midst of a global crisis worsened by the economic, commercial and financial blockade imposed by the United States government more than 60 years ago.

In this sense, the bank works based on resolutions 112 and 113, which regulates the entire legal documentation process for opening bank accounts for these clients, as well as the rules for the credit process, respectively, she added.

Calderón explained that they have been working together with some of these companies requesting credits for their work, offering, in many cases, initial working capital, a way that enables them to access bank financing for current expenses in the first three months of their activity.

In addition, working capital services are provided for the current expenses of these entities, not specifically in these three months, but during a period of one year.

In these cases, the amount for the acquisition of certain products is prioritized and the payment is made for the entire invoice in a single time, by making full use of the credit granted, which is granted to the extent that the company makes use of the same.

She noted that these MSMEs also have the opportunity to request these services for investments, including the portfolio of bank credit products, which are carried out through a feasibility study present by the company either for the purchase of fixed assets, construction or remodeling of premises or acquisition of a specific good, depending on what the client needs or demands at that time.

We are currently working on a process of opening cash and checking accounts, which provides these new actors with the opportunity to access services such as Virtual Bandec, magnetic cards for direct debit payroll for their employees and partners, access to the product card 28 to make purchases in Freely Convertible Currency and receive payments for services rendered in this same modality.

These customers soon will have access to a new service, named product 33, which will provide them with a card to make retail and wholesale purchases in national currency in the country's commercial network, Calderón Martínez added.